Employer Group ERISA 401K Plan Conversions

Why are Employers paying Billions in Federal Compliance Fees, and Class Action Lawsuits around their Employee Sponsored ERISA 401K Plans?

Supreme Court Ruling Puts 401(k) Fiduciaries on Guard

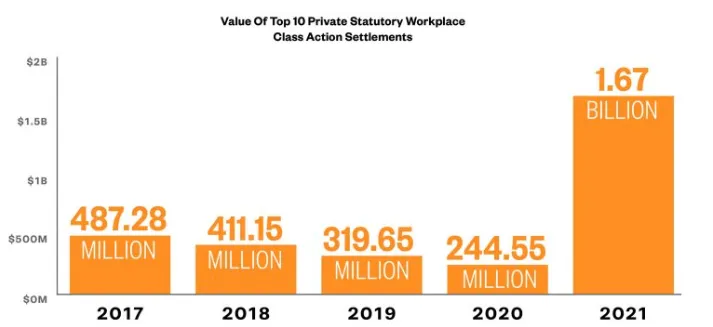

In 2021 the private sector Class Action Settlements rose by over 7x compared to 2020. This number is expected to continue to rise as Class Action Firms solicit disgruntled employees to sue their current / former employers.

Statute of Limitations Under ERISA: [5] 29 U.S.C. 1113

= 6 Years in cases of fraud or concealment.

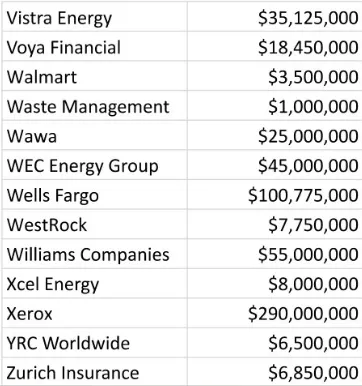

In addition to the threat of Class Action Lawsuits, employers are being

audited and fined for various different

compliance reasons over mis-management of their 401k Plan.

$1,670,000,000 - 2021 Class Actions

$6,315,662,699 - DOL Fines Levied

✅ Relieves Business Owner(s) of Fiduciary Liabilities

✅ Relieves Business Owner(s) of ERISA Responsibilities & Liabilities

✅ Provides Employees with a 5% Contribution Bonus for 8 years

✅ Downside Protection on all Plans (F.I.A.)

✅ Uncapped Index Strategies Available

✅ No T.P.A. / Bookkeeping / Administrative Fees

✅ Small expense to the Business Owner

✅ Simple & Hassle Free

✅ Contribution Limits lower vs 401k (Can add a Traditional IRA)

✅ Employer Matching Guidelines Slightly Differ (3% instead of 4%)

✅ No Loans Available on the Simple IRA / Traditional IRA

Contact us today. You don't want to risk waiting!

Your 401K conversion expert will go over the process details, address questions on available options, and provide clarity towards your next steps in hedging your company against future lawsuits.

COPYRIGHT © 2023 THE BENEFIT STORE - ALL RIGHTS RESERVED

NPN #19677564 | CA #6004127 | NV #3593959