SPLIT DOLLAR LIFE INSURANCE - LOAN METHOD

- Create a "Legacy Income & Benefits Plan" that outlasts your professional career -

A split dollar life insurance compensation plan negotiated into your Contract will trump any deferred compensation plan, provide significant financial risk reduction, and very powerful benefits outlasting your professional career. This is the most powerful method for providing substantial supplemental retirement benefits with minimal tax consequences. Let us help educate you below.

98% of CPAs either don't know this information, or cannot execute correctly, creating more of a liability. However, these tax advantaged plans have been utilized by majority of the Fortune 500 Executives, and many Professional Athletes and Coaches.

SCROLL TO DISCOVER

WHO'S DOING THIS?

Those That Understand

Take Action To Implement

It's possible for athletes and coaches to drop their effective tax rates by 20%+

WHY USE A SPLIT DOLLAR COMPENSATION PLAN?

What Is Split-Dollar Life Insurance?

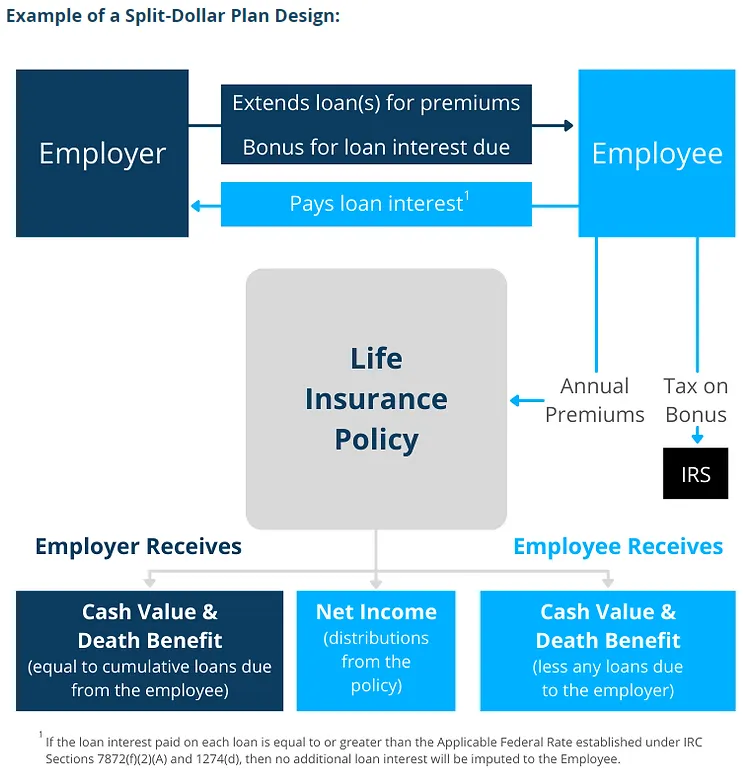

Split-dollar is a method of purchasing and paying life insurance benefits. It is not a particular kind of life insurance contract or product. The term “split-dollar” refers to any plan of permanent life insurance under which the right to policy benefits and/or the obligation to pay premiums is split between two individuals or entities. The split is between a “sponsor” (i.e., company/university/parent) and an insured (i.e., the athlete/executive/coach/child) who has a need for life insurance protection.

Typically, the corporation pays the annual premium for the permanent life insurance policy in question. In return, the corporation is allocated a share of the resulting cash value of the contract as well as a share of the death benefit. The insured is allocated a share of the death benefit and, in certain plans, a share of the contract’s cash value. The allocations of (i) premium responsibility; (ii) cash value division; and (iii) death benefit division are defined in the split-dollar agreement.

A VALUABLE INCENTIVE TO ATHLETES, COACHES, AND TEAM EXECUTIVES

Unlock The Power Of Your

Split-Dollar Executive Bonus Plan

EVERY structure is unique to YOU. It's in your best interest to schedule a free consultation so that an Expert on our Team can do a deep dive, and evaluate how to design your plan.

Loan Agreement (Harbaugh | University of Michigan Summary)

University advances $2 million per year in premiums over 7 years so long as Harbaugh continues to be head coach

Premium advances are non-interest bearing below-market term loans to be repaid upon Harbaugh’s death

Imputed income is recognized by Harbaugh for forgone interest

Obligation to repay is evidenced by a non-recourse revolving promissory note to the University

Loans are secured through a policy collateral assignment

Harbaugh is given the right to access cash value provided that immediately following the disbursement; either:

The cash value will equal or exceed 108% of the total loan; or

Based on a then current in-force illustration reflecting the current crediting rate/charges, the death benefit: (i) will not fall below 150% of the total loan in any year through age 70, and (ii) will not fall below 108% of the total loan from age 71 through 100

Michigan, Jim Harbaugh agree to increased compensation in form of life insurance loan

(Dan Murphy, ESPN Staff Writer - Aug 17, 2016)

Employer Cost Savings Group was not involved in Jim Harbaugh’s contract or the use of life insurance to create his specific program. The details of the loan agreement highlighted above were obtained from publicly available information.

While Harbaugh’s split-dollar loan is “interest-free,” it is not “cost-free.” Each year, Harbaugh must pay tax on imputed income equal to the interest that Michigan would have charged him if the loan had borne interest at the minimum IRS rate vs interest free. The arrangement could be paired with a separate retention bonus agreement that would pay Howard an additional bonus each year he had remained with the school, in an amount sufficient to cover both the interest due on the loan and the tax on the bonus—so that the program would truly be cost-free to Howard for as long as he remained with the University.

What's worse: Harbaugh wouldn’t know the full extent of his annual imputed income until all seven advances had been made on the loan—because the imputed interest rate that is applied to each advance is determined by the rate in effect at the time the advance is made.

Had Michigan loaned Harbaugh all $14 million up front in August 2016 (rather than advancing $2 million each year for 7 years), they could have locked in a 1.9% interest rate on the entire amount for the rest of Harbaugh’s life. (Had they gone this route, to be consistent with the other terms of the existing deal, Michigan could have clawed back a pro rata portion of the $14 million in the event that Harbaugh left before year seven.)

Instead, the rates in effect for installments two through 5 were 2.26%, 2.64%, 3.31% and 2.08%, respectively, which amounts to almost $54,000 of additional imputed income that Harbaugh will now have to pay tax on each year (for the rest of his life) over and above the amount he would have recognized had the entire $14 million been advanced up front.

In the interest rate environment of August 2016 vs April of 2020, if they would have advanced Howard all seven premiums up front, they could have locked in an interest rate of only 1.44% for the rest of Howard’s life.

FOR THE WIN

The Benefits of Split-Dollar Life Insurance

Our Experts have been working with split-dollar agreements for decades. We work with clients and advisors to draft and implement split-dollar plans based on the negotiated terms for both parties employer (university/team) and employee (athlete/coach).

Schedule a call with our firm if you want to discuss split-dollar in more detail.

Get Started Today!

Speak to one of our benefit experts today and receive

a complimentary illustration on how we can reduce your costs and

increase your bottom line. We work with businesses one-on-one

and handle the entire process on their behalf.

"Zero Upfront Cost - Zero Risk"