360 PHP FAQs

We have designed this FAQ section to provide an accessible resource to the most commonly asked questions.

If you have further questions, schedule a 1 on 1 with VP of Agency Development, Dan Galietto.

Why have I not heard of this program before?

The availability of Section 125 P.O.P. Preventative Health Plans leveraging WIMPER and SIMRP have been available since 2013.

However, combining these plans and using an HRA is very unique in the marketplace and has had limited exposure.

What is a fully ERISA, ACA, and IRS compliant Preventative Health Plan design look like, and how can it help employer groups?

360 PHPs installation is a specialized service that assists businesses in optimizing tax incentives through the Affordable Care Act.

Our Team has curated a comprehensive, incentivized and participatory plan design, while managing compliance at "$0 additional net-cost" to the employer or employees.

Our 360 PHP provides eligible F/T W2 employees with an unlimited preventative medical care application and up to $150,000 guaranteed issue Universal Life, Cash Value insurance policy that is fully portable (employee owned).

This provides significant financial security for employer group's employees and their beneficiaries.

A Premium Only Plan (P.O.P) is a type of cafeteria plan or employee benefit arrangement under Section 125 of the Internal Revenue Code in the United States. It allows employees to pay for certain benefits, such as health insurance premiums, with pre-tax dollars. This reduces their taxable income and, as a result, their federal income tax, Social Security tax (FICA), and Medicare tax liabilities. Employers also benefit because they reduce their payroll tax liability (FICA taxes). In its simplest form, a Section 105 HRA is a direct reimbursement plan that allows an employer to repay employees money for health care expenses.

Our 360 Preventative Health Plan was created leveraging very specific Internal Revenue Codes (Summary of Plans and Codes)

✅ IRC Code Section 105 (SIMRP)

* How it works: Employer reimburses medical expenses

* How it Saves Employers Money: Reduces premium costs: pay-as-you-go

✅ IRC Code Section 105/106 (WIMPER)

* How it works: Wellness incentives tied to reimbursements

* How it Saves Employers Money: Healthier employees reduce overall costs

✅ IRC Code Section 105 (HRA)

* How it works: Employer-funded reimbursements

* How it Saves Employers Money: Controls healthcare costs; tax advantages

✅ IRC Code Section 125 (Section 125 POP)

* How it works: Pre-tax premium contributions

* How it Saves Employers Money: Reduces payroll taxes

✅ IRC Code Section 106

* How it works: Employer-provided health benefits

* How it Saves Employers Money: Deductible for employer; tax-free for the employee

✅ IRC Code Section 105

* How it works: Medical reimbursement plan

* How it Saves Employers Money: Tax-free for employees; deductible for employers

✅ IRC Code Section 213(d)

* How it works: Defines medical expenses

* How it Saves Employers Money: Tax deductions/reimbursements for medical expenses

360 PHP Design

In order to have a compliant self-insured plan, the following provisions must be considered when determining which benefits are allowable for reimbursement:

✅ A salary reduction agreement that allows the employee to make pretax contributions to a Section 125 Cafeteria Plan to pay for qualified benefits such as group life insurance.

✅ An IRC Section 106 wellness plan funded with pretax dollars (e.g., from a cafeteria or other qualified plan)

✅ A WIMPER plan, or "Wellness Integration Medical Plan," is a type of health benefit plan that incorporates wellness incentives to encourage employees to engage in healthy behaviors.

✅ A SIMRP that provides for tax-free reimbursements of medical care expenses described in IRC Section 105(b) and defined in IRC Section 213(d). This includes, but is not limited to, insurance covering medical care.

Eligibility requirements to participate in our 360 Preventative Health Plan

Eligibility to participate in our 360 PHP must be satisfied by both of the following tests:

✅ Percentage Test: The plan must benefit 70% or more of all employees who are eligible

✅ Classification Test: The plan must benefit all employees who qualify under a given classification and cannot discriminate in favor of highly compensated individuals.

✅ It must be uniform for all participants

✅ Although certain employees may be excluded from consideration, the following classification of employees may be excluded from consideration.

Workers who...

✅ Have not completed 2 years of service prior to the beginning of the plan year

✅ Have not attained age 25 prior to the beginning of the plan year

✅ Are part-time employees (less than 30 hours per week)

✅ Are part of a collective bargaining agreement Are non-resident aliens who receive no earned income.

What is the required participation?

50+ eligible employees. Minimum 25 enrolled.

Are employees required to have major medical insurance through their employer or elsewhere (e.g., spouse or domestic partner) in order to qualify for medical reimbursements?

Yes.

Will a group be declined if they fall below the threshold of 25 or 50?

The employer group will not be declined, but there will be a discussion with the employer group to determine full benefits, if any, to install. It needs to make financial sense for all parties, and eligibility determined on a case by case basis.

360 PHP programs save employers money

A 360 PHP program saves employers money due to a reduction in FICA taxes paid because the amount elected by the employee to be contributed to the plan is not considered to be wages and therefore not taxable for Social Security purposes. It should also be noted that a PHP is only subject to federal law, not state insurance regulations.

Are employers guaranteed to save money through a 360 PHP?

Yes, as Gross Wages are lowered there is less FICA taxes resulting in a savings to the employer.

What are the immediate tax savings for employers and employees?

An employer will realize their tax saving as soon as their first payroll after the plan is in force.

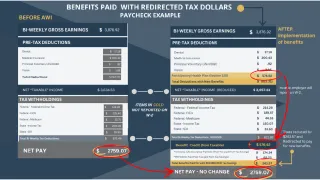

How does this work with Payroll? (Paycheck Example - Detailed math breakdown)

Okay, let's go over how this works with a bi-weekly paycheck example.

Although this is a bi-weekly paycheck example, when we put together a custom proposal for your group clients, we will adjust accordingly to their existing pay schedule, whether weekly, bi-weekly, semi-monthly, or monthly.

If you look at the left column, we're looking at a paycheck example with pre-tax deductions typical on an employee's paycheck.

You have your standard Dental, Medical, Employer owned life insurance, and vision coverage, with a NET taxable income of $3,634.53.

In the right column, our example shows an employee with a W-4 election of Single. By utilizing a pre-tax deduction Section 125 Premium Only Plan, we're able to use $576.92 as the total Benefit Credit that can be re-allocated towards the Participatory Health Plan.

This brings the new total bi-weekly deductions, with benefits, to $819.31.

Because the net taxable income has been reduced, there will be a reduction in tax withholdings, which in this example, we're using the total adjusted tax withholdings of $631.89.

When you subtract the tax withholdings of $631.89 from the net income of $3,057.61, you get an adjusted net pay of $2,425.72.

As you see on the left column, the net pay was $2,759.07, and now it's $2,425.72.

In accordance with IRC Section 105(b), which allows us to utilize a HRA Reimbursement for the Benefit Credit, which in this case is $576.92, we're adding the benefit credit to the new adjusted net pay of $2,425.72 for a net income of $3,000.64.

Considering the original net pay of $2,759.07, that leaves us with a remaining $243.57 Benefit Credit that we can apply towards the additional benefits.

You can see in the example in the right-hand column that we're covering the low 360 PHP Admin Fee of $69.23, and putting the rest of the Benefit Credit, which in this example is $174.34, towards the Universal Life Insurance Premium.

By applying the $243.57 that was remaining, we've fully maximized the benefit credit, and you can see that by re-allocating the savings that we would normally be sending to the IRS, we're now able to purchase benefits with them, and because of the HRA Reimbursement, which falls under IRC Section 105(b), the net pay remains the same at $2,759.07.

Are the tax savings and cost benefits realized immediately after program implementation or at tax time?

Immediately

What are the benefits of the 360 PHP?

The 360 PHP includes 24/7 Tele-Health appointments with no cap, a health risk assessment that generates comprehensive positive steps to take to improve one's over-all health.

The plan is Participatory, and employees are required to have some activity to use the program and possibly receive employer incentives. Such as the up to $150,000 Universal, Cash Value, Fully Portable, Life Insurance Policy.

You can preview the details of our plan design and benefits by previewing our Agency presentation: https://www.thebenefitstore.com/group-benefits-agencies

Can an employee take their Life Insurance policy as cash?

No, the program is set up to be a packaged bundle and there is no cash in lieu of benefits. However, the Life insurance is portable and accrues cash.

The ACA and Self-Insured Healthcare Programs

The ACA increased incentives for employers to adopt self-insured healthcare programs. More focus is being placed on consumer based approaches with an emphasis on preventative care. One approach is to establish a Wellness and Integrated Medical Plan Expense Reimbursement (WIMPER) program. This unified health care approach provides a tax-advantage, affordable means to purchase secondary health insurance products. A medical insurance plan along with a well-designed wellness program encourages employees to take personal responsibility to help minimize healthcare costs.

360 PHPs are the perfect plan

Employees may want to take part in a WIMPER program as the unified platform provides an opportunity to purchase additional benefits that might not otherwise be affordable without affecting their net pay.

IRC Section 106(a) allows employers to make pretax contributions to a wellness plan (e.g., an accident and health plan). These pre-tax contributions are made at the election of the employee through a written salary reduction agreement that is the basis for a Section 125 Cafeteria Plan. By contributing a portion of their salary to pay for qualified benefits, employees reduce their Taxable wages and Compensation, as the contributions are taken from Gross Wages and not considered for income tax purposes.

A WIMPER program allows a company to make a benefit allowance available to employees with reimbursements for participation in a wellness plan. This differs from traditional benefit programs where an employer chooses and administers a healthcare plan.

This results in lower Federal Insurance Contributions Act (FICA) taxes for both the employer and employee.

PHPs offered in conjunction with group health plans

Participatory plans are the most common type of PHP and may either offer no reward or provide one that does not require satisfying a health-related standard (i.e., awarded without regard to one’s health status). Although an enrollee must participate in the program, the reward is not contingent upon achieving a specific goal or outcome; such as the employee being required to attend or participate in a smoking cessation program and subsequently quit smoking. Other common examples of rewards include general education seminars as well as reimbursements for gym memberships and diagnostic testing programs.

Activity only plans are based on a health factor and require an individual to complete a health-related activity in order to receive an award. Common examples include diet and exercise programs.

360 PHP requires that a member take action at least once per month, with reminders provided by the application after completing some basic tasks such as...

✅ Log in to generate a password (=1 activity)

✅ Fill out a Health Assessment Questionnaire (=1 activity)

✅ Watching a video on a health related topic (=1 activity)

✅ Subsequently, employees can choose from a plethora of other activities they can do to fulfill the requirement such as watching videos on some topic they want to know more about, etc.

IRS Tax codes that allow these benefits to be administered

IRC 125 Cafeteria Plan - Salary Reduction Agreement

IRC 106 Accident & Health Funding - Pre-tax contributions self funded wellness plan

IRC 106 Accident & Health Benefits - After-tax benefit received from wellness plan participation (allow for same net pay & fees paid)

To enhance the components of the PHP, employers can leverage IRC Section 106, which permits the establishment of PHPs funded with pretax dollars. Integrating PHP initiatives into the program not only aligns with the broader objectives of employee health, but also provides tax advantages for both employers and employees. IRC Section 106 can be harnessed to create a robust PHP framework also called the WIMPER program.

IRC 105 SIMRP - Self insured medical expense reimbursement plan - Balance used for medical expense reimbursement

A critical aspect of the PHP's medical expense reimbursement component is the implementation of a SIMRP (Self-Insured Medical Reimbursement Plan). The SIMRP is designed to facilitate tax-free reimbursements of medical care expenses outlined in IRC Section 105(b) and defined in IRC Section 213(d). Next slide covers specifics of what qualifies as reimbursable medical care expenses, providing clarity on the scope of coverage under the PHP.

IRC 213(d) Medical Expenses - Reimbursed medical expenses described in IRC 105(b) & defined in IRC 213(d) include insurance

Among the IRC Section 213(d) reimbursable medical care expenses, insurance covering medical care stands out as a pivotal element of the PHP. This includes health, dental, vision coverage, Tele-Medicine, Tele-psychiatry, and many more. Parameters outlined in is essential for ensuring that the insurance offerings align with the regulatory requirements while providing comprehensive coverage for employees.

In conclusion, the combination of a Section 125 POP Plan in conjunction with Section 105 a self-insured platform which falls within the scope of the Internal Revenue Code, Affordable Care Act and other regulatory laws and regulations, is in compliance, and employee-centric approaches. By carefully considering the provisions we’ve covered, employers can deploy our PHP which not only meets regulatory standards, but also fosters a culture of health and well-being, ultimately benefiting both employees and the organization as a whole.

360 Preventative Health Plan Compliance & Opinion Letter

We have an Opinion Letter from one of the most well respected and well known CPAs and Tax Attorneys in this space. Peter Karl III of Paravati, Karl, Green & DeBELLA, LLP is our Chief Compliance Counsel.

You may find his detailed bio here: http://thebenefitstore.com/our-team

IRS Office of Chief Counsel Memorandum Number 201622031

The IRS Office of Chief Counsel Memorandum Number 201622031, dated April 14, 2016, addressed the exclusion of cash rewards paid to employees for participating in a preventative health program, including premium reimbursement. This memorandum stated that although the preventative health plan qualified under I.R.C. §§105 and 106, the payments were taxable. The reasoning was twofold: first, part of the benefit payments covered benefits that did not qualify as I.R.C. §213(d) medical expenses, and second, the payments did not meet the I.R.C. §105(b) exclusion because participants received benefits whether or not they incurred the expense. Our PHP, however, is different from the program reviewed by the IRS because it meets both of these disqualifying requirements. All benefits under the program are I.R.C. §213(d) qualified expenses, and employees must actively participate in the 360 Preventative Health Program after completing the salary reduction agreement before receiving any benefit payments. The charge for participation is deducted on a per-paycheck basis under the employer's POP Cafeteria Plan.

Our 360 Preventative Health Plan is medical care not a fixed indemnity plan.

IRS Office of Chief Counsel Memorandum Number 201703013

IRS Office of Chief Counsel Memorandum Number 201703013, dated December 12, 2016, addressed the tax treatment of benefits paid by a fixed-indemnity health plan. The memorandum concluded that an employer cannot exclude from an employee's gross income payments made under an employer-provided fixed indemnity health plan if the value of the coverage was already excluded from the employee's gross income and wages. However, it's important to note that this ruling does not apply to the 360 Preventative Health Program because the our 360 Preventative Health Program is not a fixed indemnity health plan. The IRS Chief Counsel's analysis also confirmed that the value of coverage provided by an employer provided preventative health program that offers medical care, as defined under §213(d), is generally excluded from an employee's gross income under §106(a), and any reimbursement or payments for medical care (as defined under §213(d)) provided by the program are excluded from the employee's gross income under§105(b). This statement effectively summarizes the operational principles of our 360 Preventative Health Program.

What if any are the tax penalties for using a PHP? Is there compliance help?

The Benefit Store, Powered by Oaceus have aligned with the most knowledgeable and experience CPAs and Tax Attorneys in this space. One of them being our Chief Compliance Counsel, Peter Karl III. Our CPAs or Tax Attorneys are more than happy to get on calls with an employer groups CPAs, Attorneys, HR, etc.

You may find Mr. Karl's bio here: https://www.thebenefitstore.com/our-team

What are the costs of enrolling in the 360 PHP + Risk Mitigation Platform?

There are "$0 additional net costs" to the employer or employees. There are no costs that are unreimbursed for employees, employer costs are generally covered by FICA savings.

How does an Employer Group enroll with the 360 PHP + Risk Mitigation Platform?

The client can enroll via an auto enroll with opt out forms or using our proprietary online enrollment system.

What will your payroll team need to do to participate in this program?

They can provide the necessary payroll reports, which vary by group and/or allow us to link to their payroll program.

How long is the enrollment process from start to finish?

Once all the payroll documents are received, the enrollment process is 2-3 days from submission to implementation.

COPYRIGHT © 2024 THE BENEFIT STORE - ALL RIGHTS RESERVED

NPN #19677564 | CA #6004127 | NV #3593959